Single Touch Payroll (STP)

All employers, including those with closely-held employees (e.g. directors), need to be using STP reporting for all payroll activity. The ATO have been rolling out this to employers since July 2018 designed to assist employees gain greater access to their payroll information but mainly for data-matching within the ATO and Services Australia.

This was officially extended to closely-held employees from July 2021 which, although STP is designed to streamline the process of taking money out of your company or trust, it has created additional complexities to your accounting processes. We will take care of this for you as your accountant.

Do not hesitate to contact us if you have any questions or jump to your relevant section below for more info and links:

For Employers

If you have staff, you should already be reporting under Single Touch Payroll in your business’ accounting software. We are here to help make reporting with STP as painless as possible and offer compliant STP services from bringing your software up to date and STP-ready all the way to processing your payroll each pay run for you.

See below software support links for more technical step-through guidance.

Need more understanding for yourself? The ATO's explanation on STP and what is required from you as an employer: https://www.ato.gov.au/Business/Single-Touch-Payroll/

Software

Support links below to assist you in ensuring your accounting software is correctly setup for STP or please make contact us with for more help.

ATO Categories Quick Reference

STP Phase 2 reporting – Quick reference guide | Australian Taxation Office (ato.gov.au)MYOB Business

Xero:

Quickbooks:

Low-Cost Solutions: https://softwaredevelopers.ato.gov.au/product-register

Free Option: https://www.freeaccountingsoftware.com.au/single_touch_payroll

EOFY Finalisation

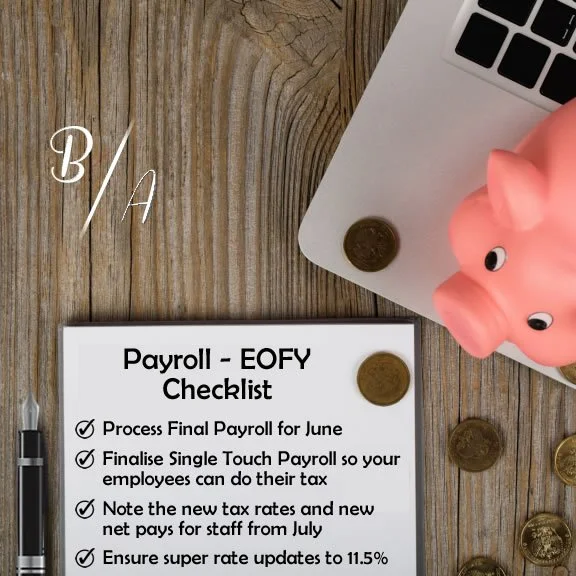

At the end of each financial year, the payroll data needs to be “finalised”. This process confirms the data is correct and allows the employees to receive accurate Income Statements to their myGov account for the preparations of their tax returns.

The following needs to be confirmed in your software from 1st July each year:

Tax rates need to have updated within the first payroll entry processed for the new financial year. Your employees’ net pays may change so bank transfers may need to be updated to match. Click here for more information for the relevant financial year.

Superannuation rates need to be have updated and accrued at the new rate. Click here for more information.

Due date: this must be completed by 14th July each year.

Software links below to assist you in the finalisation process for your employees or take advantage of our service for this.

For Employees

Single Touch Payroll is your gateway to your payroll data throughout a financial year so you don’t need to wait until tax time to know where you’re at or if you change jobs mid-year. All you need is your myGov account.

Your Income Statement will be confirmed by 14th July each year by your employer and advised to you via your myGov account inbox. Check with your employer if you’re unsure or ask us for help.

The ATO’s explanation on what STP means for you: https://www.ato.gov.au/Business/Single-Touch-Payroll/Single-Touch-Payroll-for-employees/What-Single-Touch-Payroll-means-for-employees/